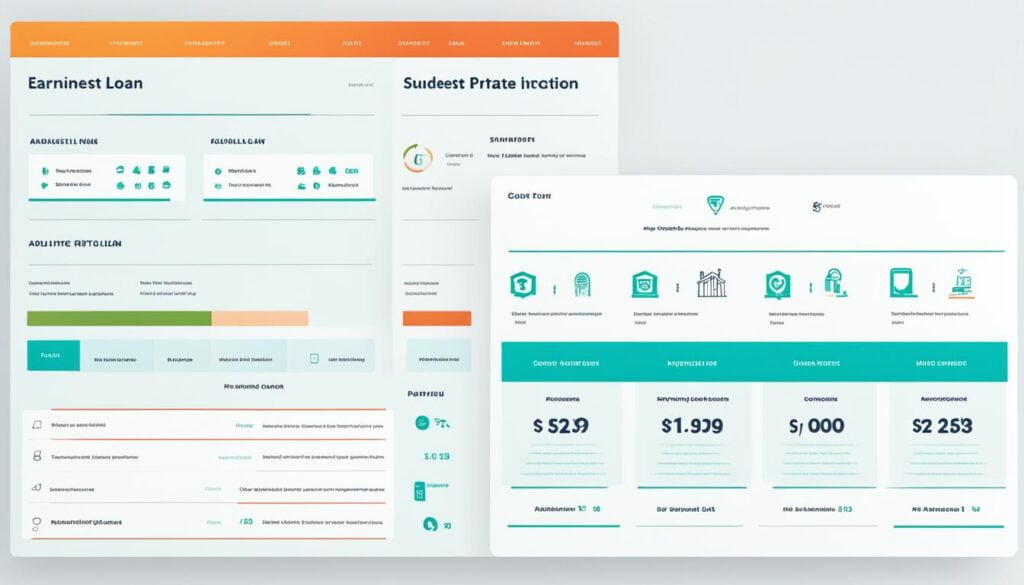

If you’re looking for a good way to pay for college, consider Earnest’s student loans. You can get loans with really low rates. For example, cosigned loans can start as low as 4.29% APR after a 0.25% discount. Independent loans start at 5.60% APR after the same discount. And the best part is, there are no fees with Earnest. That means no origination fees, late fees, or prepayment penalties. You won’t have to worry about extra costs while you study.

Earnest wants to make borrowing money for school easier and better. They offer help tailored to your needs and repayment plans that fit your budget. They are also upfront about everything. You’re guaranteed to get the best rate, and they’ll give you a $100 Amazon gift card. With Earnest, getting the money you need for college is straightforward and fair.

But that’s not all. Earnest’s loans can cover everything you need for school, including study abroad. Applying is easy and secure. You can check if you’re eligible in just 2 minutes, apply on your phone, and not worry about the safety of your information.

Key Takeaways

- Earnest offers some of the lowest starting interest rates for private student loans and refinancing, including a 0.25% Auto Pay discount

- Cosigned loans typically have lower interest rates than independent loans due to the longer credit history of the cosigner

- Earnest’s private student loans have no fees, including origination, late payment, or prepayment fees

- Earnest provides a 100% Rate Match Guarantee and a $100 Amazon gift card as a bonus

- The application process is streamlined, with a 2-minute eligibility check and mobile-friendly platform

Introducing Earnest: A New Approach to Private Student Loans

Earnest is changing how people see private student loans. It offers loans that are personal, clear, and easy to adapt. Unlike banks, Earnest focuses on each student’s needs and money situation.

Personalized Guidance and Support

Earnest values giving each student personal advice and support. Their Client Happiness team helps students understand their goals and how to reach them. They offer advice that fits each student’s unique journey.

Flexible Repayment Options

Many times, standard repayment plans aren’t enough. Earnest knows this and lets students adjust their plan. This means students can change how long they have to repay or how much they pay each month. It helps them find a balance that works for them.

No Hidden Fees or Surprises

Transparency is very important to Earnest. There are no hidden fees with their loans. No extra surprises like added fees for starting late, paying late, or paying early. This helps students focus on paying their loans back fully.

Earnest is making private student loans better. They offer personalized help, easy repayment options, and no extra fees. This way, students can pursue their education without financial stress.

earnest private student loans: Competitive Interest Rates

Earnest is proud to provide private student loans with low starting interest rates. Borrowers can enjoy these competitive rates. Additionally, if they set up automatic payments, they get a 0.25% discount.

Cosigned vs. Independent Rates

Cosigned loans at Earnest start at 4.29% APR, after the 0.25% Auto Pay discount. Independent loans begin at 5.60% APR, also with the Auto Pay discount. A cosigner’s good credit helps get lower rates, making it easier for students to find good loan options.

Auto Pay Discount

Earnest aims to save students money on their loans through its rates. With the 0.25% Auto Pay discount, borrowers can cut down on payments. Working with a cosigner means even lower rates, saving a lot of money over time. This mix of low rates and ways to pay is a great choice for student loan needs.

| Loan Type | Interest Rate (including 0.25% Auto Pay discount) |

|---|---|

| Cosigned Fixed Rates | 4.29% |

| Independent Fixed Rates | 5.60% |

The table shows how Earnest leads in low rates for private student loans, especially for cosigned loans. Through Auto Pay and using a cosigner, students can save a lot of money over their loan’s life.

Comprehensive Coverage for College Expenses

Earnest private student loans are known for covering more than just tuition. They help pay for other college needs too. This includes tuition and fees, books and supplies, and study abroad costs.

Tuition and Fees

Earnest can cover 100% of your tuition and mandatory fees with their loans. This lets students focus on their studies. They don’t have to stress about paying for important educational costs.

Books and Supplies

These loans can also pay for needs like textbooks and laptops. On average, students spend $1,200 yearly on these items. Having this help for costs can make a big difference for students.

Study Abroad Costs

Studying abroad is a valuable part of many students’ college experience. Earnest’s loans can cover study abroad costs. This includes tuition, living costs, and travel expenses.

With Earnest, students can tackle many expenses related to college. This support lightens the load, letting students focus on their studies. It’s a way to help students thrive in their educational journey.

Streamlined Application Process

Earnest knows applying for a earnest private student loan should be easy. Their approach is simple and stress-free.

2-Minute Eligibility Check

The first step is a 2-minute eligibility check that doesn’t hurt your credit. It helps you see what loans you might get without worries.

Mobile-Friendly Platform

Earnest’s site works well on mobile. You can apply from a computer, tablet, or phone. It makes applying easier for everyone.

Encrypted Data Protection

Keeping your info safe is vital for Earnest. They use the best data encryption to protect your personal and financial details.

Earnest makes it easy to apply for your student loan. From the 2-minute check to mobile-friendly and secure steps, they focus on a smooth process.

Ongoing Support and Flexibility

At Earnest, we know student loans go beyond just the start. We’re here to help our borrowers long after they sign up. We offer personal service and the flexibility to manage money easily.

In-House Client Happiness Team

Earnest has a special Client Happiness team just for you. They’re here to answer your questions and solve problems, making sure you have a great experience with us. Our team knows student loans and is always ready to support you.

Adjustable Term and Payment Options

Not everyone fits in the same box, and we get that at Earnest. We let our borrowers adjust their payment plans to suit their needs. This way, you can control how you pay for school and keep a budget that works.

Grace Period and Deferment Availability

Sometimes, things happen that make paying back hard. That’s why we have a option. It lets you stop or lower payments for a while if you’re going through a tough time.

Industry Recognition and Trustworthiness

Earnest is known for their trustworthy service in the industry. More than 6,300 clients have reviewed them, giving an average of 4.7 stars. Earnest is also a top pick at over 890 universities nationwide, showing they take trust and reliability seriously.

Positive Customer Reviews

Earnest is dedicated to providing great service and value. This effort has won them the trust of customers and the education community. They are recognized as one of the top loan companies for student loans in the US. Their standing as a preferred lender at many universities supports their good reputation.

Preferred Lender at Numerous Universities

Many clients, over 269,000, trust Earnest for their loan needs. This is seen in both the great reviews they’ve received and their partnership with numerous universities. Earnest stands out as a trusted choice for private student loans.

Conclusion

Earnest stands out as a top choice for private student loans. It provides low rates and excellent customer support. The company has changed the game with its personalized guidance and easy application process. This has led to many happy customers and good industry reviews.

NerdWallet gives Earnest a high rating for its student loans. They offer loans for all types of students. Earnest is clear about costs and offers flexible plans. This has helped them gain trust and loyalty from their clients.

Earnest is growing and becoming more popular at universities nationwide. It’s helping students and families reach their education dreams. Earnest is making a big impact in the private student loan world.

FAQ

What are the key features of Earnest’s private student loans?

Earnest’s private student loans start with very low interest rates. There are no extra fees, and you get a 0.25% discount for Auto Pay. They help with personalized advice, flexible pay options, and cover almost all costs a college certifies.

How do Earnest’s private student loan rates compare to other lenders?

Earnest offers great rates for private student loans. Cosigned loans start at 4.29% APR, and independent loans start at 5.60% APR. These rates are after the 0.25% Auto Pay discount.

What expenses can Earnest’s private student loans cover?

Earnest’s loans can pay for many college expenses. This includes tuition, fees, books, supplies, and costs for studying abroad. They can cover up to 100% of what your school approves.

How easy is it to apply for an Earnest private student loan?

Getting an Earnest private student loan is easy. In just 2 minutes, you can check if you’re eligible without hurting your credit. The application is easy to fill out on a phone or computer, and your information is very secure.

What kind of support and flexibility does Earnest offer to its private student loan borrowers?

Earnest offers a lot of support and flexibility. They have a team ready to help you and let you change your loan or payment dates. You can also get a 9-month pause in payments or choose to defer. They really make it friendly for students.

How trustworthy and reliable is Earnest as a private student loan lender?

Earnest is known for being reliable. More than 6,300 customers have given them an average of 4.7 stars. They’re also trusted at over 890 universities. This shows they’re a top choice in the education finance world.